Bitcoin may fall below $12,000

'bears' gained a technical advantage against the backdrop of the liquidity crisis of the FTX crypto exchange

Bitcoin (BTC)’s efforts to break out of so-called ‘Bitcoin May Fall Below $12,000 – Bears Gain Technical Advantage Amid FTX Liquidity Crisis’ have failed following a high-profile liquidity crisis affecting FTX. As a result, the flagship cryptocurrency has adjusted to near its two-year low, and ‘Bitcoin bulls may fall below $12,000 – bears have gained technical advantage amid FTX’s liquidity crisis’ look helpless.

Kitco News analyst Jim Wyckoff says in a Nov. 9 article that bears have quickly gained technical strength to exert even more price pressure in the near term. He also noted that the failures of FTX in general undermined investor confidence, and the market should expect ‘serious liquidity crises’ in the future.

“The market is still buzzing about the turmoil in cryptocurrency markets on Tuesday, which spilled over into safe-haven buying of gold and sent the yellow metal and silver sharply higher,” he wrote.

Another crypto analyst, who goes by the Twitter handle AltcoinSherpa, suggested that given the current market conditions, Bitcoin’s next price action could follow historical trends.

$BTC: Here are my lower levels if/when things get really bad. 12k would be very strong support, let's hope price doesn't get there. Notes on the chart. #BTC #Bitcoin pic.twitter.com/KPnsjjZSlU

— Altcoin Sherpa (@AltcoinSherpa) November 9, 2022

According to the expert, the asset can adjust to $12,000, which will form its strong resistance. He also said that the $20,000 position is ‘significantly compromised.’

AltcoinSherpa said that if the $12,000 level is reached, Bitcoin is likely to see increased buying pressure.

Cryptocurrency trading expert Michael van de Poppe noted that the drop to $10,000 is relevant, but the correction will depend on how the market reacts to the crisis.

Could the markets fall towards $10K for #Bitcoin?

Definitely, that's a likely possibility or $12-14K too, all depending on how things are going to develop from here.

However, I wouldn't dare to start shorting #Bitcoin here.

Rather DCA & invest.

— Michaël van de Poppe (@CryptoMichNL) November 9, 2022

For his part, Bloomberg Intelligence commodity strategist Mike McGlone said that a decline in the cryptocurrency market can cause capitulation in other markets — this is a so-called ‘macroeconomic domino.’

This Bitcoin, Crypto Slump May Trigger Macroeconomic Dominoes – The breakdown of #Bitcoin and #crypto assets may trigger capitulation sell stops in most markets that have been under pressure this year. pic.twitter.com/p2Uq5pSJye

— Mike McGlone (@mikemcglone11) November 9, 2022

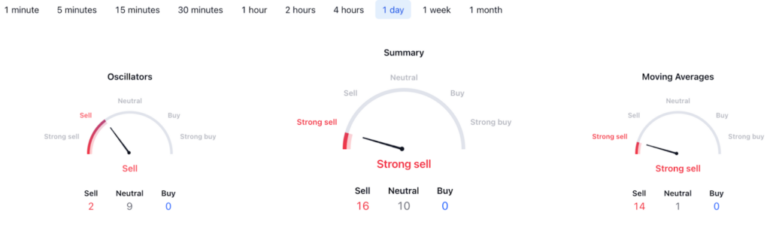

The ‘bearish’ forecast also extended to the technical characteristics of Bitcoin. At the end of one day, the “Summary” indicator indicates “strong sales” at the 16 mark; the same is fixed by the moving average (MA) indicator — at level 14. Oscillators show “selling” at level 2.

Meanwhile, Bitcoin continues its free fall and was at $17,200 as of the evening of November 9, having lost 11% in the last 24 hours.

In total, since the beginning of the year, the cryptocurrency market has lost almost $1 trillion in market capitalization under the pressure of a number of factors (increasing inflation around the world and the war in Ukraine), which culminated in a series of bankruptcies involving crypto hedge funds and lenders, including Celsius Network, Voyager Digital and Three Arrows Capital and the downsizing of companies like Blockchain.com and Coinbase.

According to data collected by Finbold, the number of Bitcoin millionaires decreased by 70.23% in the first three quarters of 2022 due to the “bear market”, and as of September 28, 2022, the total number of Bitcoin millionaires was only 29,497.