Microsoft and Apple: the history of the struggle for supremacy

How did Microsoft manage to catch up with Apple in terms of capitalization?

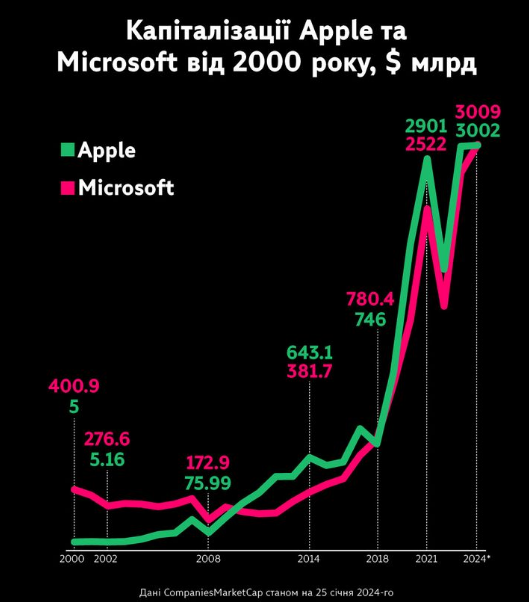

In recent years, Microsoft and Apple have been competing for the top spot in Wall Street market capitalization. Moreover, this struggle reached its peak in early January 2024, as the iPhone manufacturer had already briefly lost its crown to the software giant several times.

And on January 24, 2024, Microsoft became the second company in history to reach a market capitalization of $3 trillion, and this was virtually immediately after it laid off 1,900 employees from its gaming division.

We tell you how Microsoft managed to overtake Apple in terms of capitalization and cross the $3 trillion mark.

The history of the struggle between Microsoft and Apple

Apple and Microsoft have been rivals since the 1980s, when the company founded by Steve Jobs and Steve Wozniak accused Windows developer Bill Gates of stealing the “look and feel” of its Macintosh software. In the early 1990s, Apple lost a high-profile lawsuit over the copyright protection of Windows, clearing the way for Microsoft to dominate the computer market for decades.

But thanks to the success of the iPhone, Apple’s market value finally overtook Microsoft in 2010, a position it held for several years while Windows struggled to move into mobile computing.

Microsoft briefly outperformed Apple during the Covid-19 pandemic in 2020 and 2021, as its strength in cloud computing during the remote work boom made its business more resilient when iPhone production was suspended due to factory closures and supply issues. However, each time Apple regained the lead soon after.

In 2024, Microsoft has already caught up with Apple several times, and recently recorded a capitalization of $3 trillion.

What contributed to the growth of Microsoft’s capitalization

Microsoft has enjoyed financial success in recent months thanks to the company’s vector in the significant use of AI and the company’s $13 billion investment in OpenAI, although this has led to several lawsuits against the tech giant. A few weeks ago, Microsoft held an event to demonstrate its AI capabilities, which was well received by Wall Street analysts, CNBC reports.

Copilot, a digital assistant, and Azure Cloud, a cloud computing platform designed to compete with Alphabet’s Amazon Web Services and Google Cloud, were also successful, pushing Microsoft shares up 57% last year.

Microsoft also has a much clearer AI roadmap, and it has done a lot to articulate how AI will accelerate growth to make its long-term prospects even more compelling,

said David Katz, chief investment officer of Matrix Asset Advisors, in an interview with Bloomberg.

The upheaval in the rankings of the world’s leading companies caused by AI has also brought Nvidia, an AI chipmaker whose shares rose by about 11% in 2024, close to Amazon’s $1.6 trillion market capitalization.

According to LSEG data, the 54 analysts covering Microsoft stock had an average target price of $425, up from $415 a month ago, and their average recommendation was Buy.

Supported by optimism about AI, Microsoft shares grew by almost 57% in 2023 and 7% in 2024. Last year, Apple’s shares rose 48%, and since the beginning of this year, they have risen by about 1%.

What contributed to the fall and moderate growth of Apple’s capitalization

After becoming the first company with a $1 trillion turnover in August 2018, it took Apple just two years to surpass the $2 trillion mark in August 2020. Although Apple’s capitalization reached $3 trillion in the summer of 2023, the growth in capitalization was very moderate. And here’s why.

Apple has largely been left out of the AI craze that has swept Microsoft, which is the largest sponsor of OpenAI and a cloud hosting provider, as well as a pioneer in implementing AI chatbots in its search and work products.

At the same time, concerns about declining iPhone sales, especially in China, affected Apple’s stock in the first days of 2024, leading to a series of downgrades by Wall Street analysts.

On the other hand, analysts at Barclays and Redburn Atlantic Equities recently downgraded Apple. The firms cited a slowdown in sales of Apple’s iPhone, and Barclays shared its concerns about sales of Mac computers.

If you compare the two companies, the growth that Apple is showing is nothing special, while Microsoft has done a better job of showing profit growth,

David Katz said.

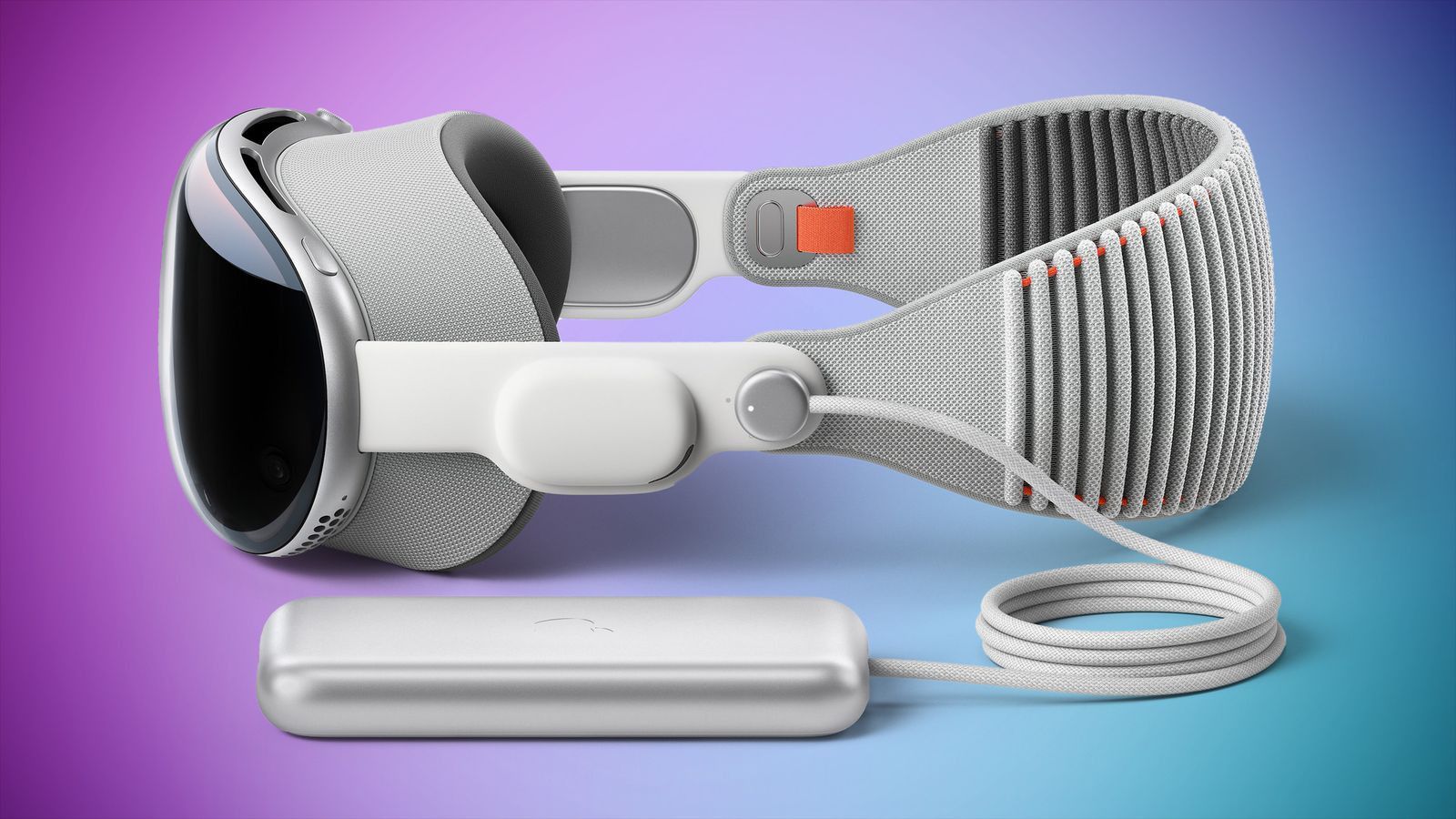

While Microsoft has focused on AI, Apple hopes that the launch of its new Vision Pro headset will usher in a new era of spatial computing that relies on rich 3D graphics and new types of hand gestures to make interaction more natural and intuitive.

However, the prospects are rather vague, as most major app developers, according to Bloomberg, are not ready to adapt their products to Apple Vision Pro or do not plan to develop apps for it at all, although Apple assures that more than 1 million apps will support the new device by the time Vision Pro is launched.