Officials exclude Rolls-Royce, Ferrari, Lamborghini cars from Ukrainian luxury tax – Bihus.Info

Rolls-Royce, Ferrari, and Lamborghini cars are not on the Ukrainian list of luxury cars and are not subject to the 25 thousand vehicle tax this year. UAH.

Every year, the State Enterprise “Derzhzovnishinform” prepares a list of cars whose owners must pay 25 thousand dollars. UAH – the so-called “luxury tax”. This year’s list was published on the website of the Ministry of Economy in February 2024.

It omits many car models, some luxury brands in general, and contains trivial mistakes that can be used as loopholes to avoid paying tax. This is stated in the story of Bihus.Info.

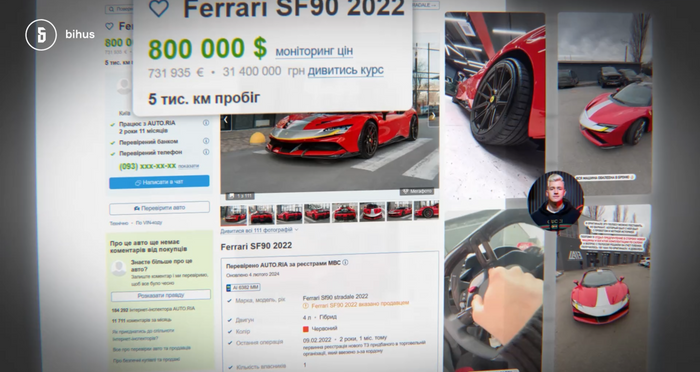

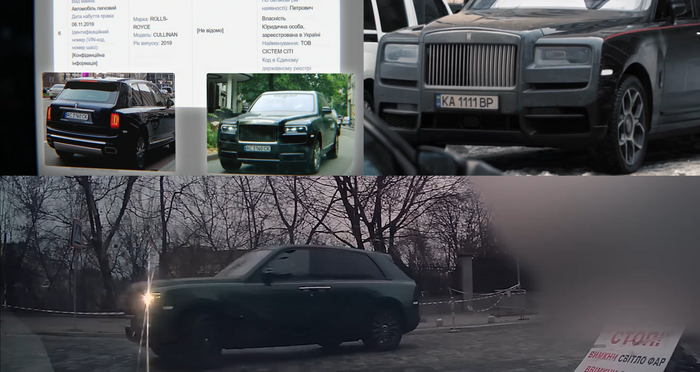

The list of cars whose owners will have to pay the vehicle tax in 2024 does not include Ferrari cars at all. According to the auto.ria website, they are the most expensive on the Ukrainian car market. Two SF90s from 2022 are currently being sold for $650 thousand and $800 thousand-the more expensive one was part of the collection of 25-year-old millionaire Alexander Slobozhenko. Also, the list from the Ministry of Economy’s website does not include Rolls-Royce cars at all.

Ukrainian MPs use cars of this British brand. For example, MPs Stepan Ivakhiv, Suto Mamoyan, and Hennadiy Vatsak were spotted driving Cullinan crossovers. Vatsak’s confectionery also owns a Rolls-Royce Ghost sedan and a Lamborghini Urus crossover. Cars of this Italian brand are also not on this year’s list on the website of the Ministry of Economy.

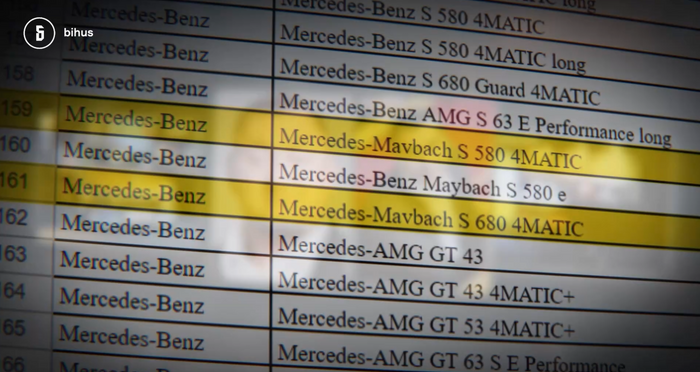

Also, the list does not include McLaren, Alpina, a number of Mercedes-Benz models that should be taxed based on the price criterion, and many others.

In addition, there are errors in the list that allow you to avoid paying tax even for those cars that are on the list. For example, three Bentley models have incorrect engine sizes, and Mercedes-Maybach sedans are listed with a mistake – MaVbach.

As a reminder, the transport tax is a payment of UAH 25,000 per year for owners of cars that are no more than five years old and whose average market value exceeds 375 minimum wages (this year it is about UAH 2.7 million). The average market value is calculated using a special formula.

The list of cars subject to taxation is prepared by the State Enterprise Derzhzovnishinform and published on the website of the Ministry of Economy. It specifies specific makes, models, engine sizes, age of the car, and the equipment or version for which it will be paid, so that owners clearly understand that it is their vehicle that is subject to taxation.