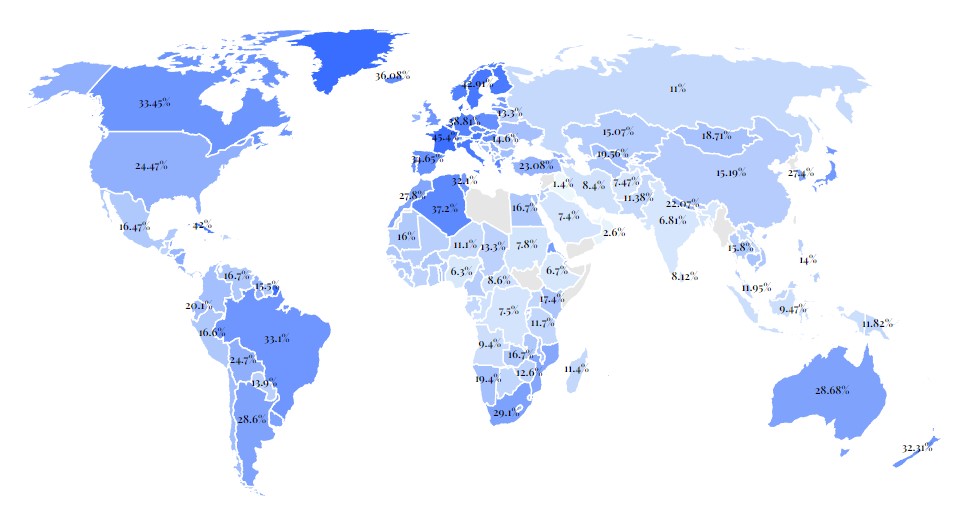

The approach to taxation differs significantly from country to country. In some places, personal income taxes are incredibly high due to progressive systems and the availability of significant social support for citizens. In other countries, there is no personal income tax at all, but the corporate tax is quite impressive.

Experts from Wisevoter told about the countries with the highest and lowest tax rates.

Top 10 countries by income tax rate

Traditionally, Europe has the highest taxes, with some exceptions. The list includes Sweden, Denmark, Belgium, etc. where the rate exceeds 40%. And Germany and France are known for their high corporate taxes. The reason for this is determined by the economic situation of each state and the structure of expenditures.

For example, Denmark, although it requires large contributions from its citizens, has an extensive social security system. In other words, it provides generous benefits to families and individuals, invests heavily in healthcare and infrastructure development, education and culture, etc. Plus, if you get a higher salary, you have to pay more, and vice versa.

Thus, the top ten countries with the highest personal income tax rates include:

- Denmark – 46.34%;

- France – 45.4%;

- Belgium – 42.92%;

- Sweden – 42.91%;

- Italy – 42.45%;

- Austria – 42.44%;

- Finland – 42.19%;

- Cuba – 42%;

- Norway – 39.93%;

- The Netherlands – 39.33%.

Where to pay the lowest taxes

At the other end of the ranking, the minimum tax rate is only 1%. This makes the state a great place for individuals and companies that do not want to pay a significant portion of their profits to the budget. For example, in the United Arab Emirates, entrepreneurs are not used as a tool to replenish the treasury. Therefore, tax rates are rather nominal and serve as an incentive for economic development.

The top 10 countries with the lowest personal income tax rates are:

- United Arab Emirates – 1%;

- Kuwait – 1.40%;

- Iraq – 1.40%;

- Oman – 2.60%;

- Bahrain – 3.02%;

- Nigeria – 6.30%;

- Equatorial Guinea – 6.30%;

- East Timor – 6.32%;

- Ethiopia – 6.70%;

- India – 6.81%.

It can be concluded that the governments of these countries have provided their populations with a number of benefits to motivate them to start their own businesses, expand their operations, and earn money. Not surprisingly, these countries mostly attract wealthy individuals who like the idea of not losing their income due to tax liabilities.

How much Ukrainians will pay in 2024

If we compare personal income tax rates, Ukraine is roughly in the middle of the ranking of countries. As of 2024, the income tax rate is 18%, as well as 1.5% military duty. At the same time, we should not forget about other tax burdens on employers. After all, they need to pay a single social contribution to the budget for each employee in the amount of 22% of the salary.

Individual entrepreneurs on the simplified taxation system have different rates. Representatives of Group 1 pay 10% of the subsistence minimum to the state each month, which in 2024 is equal to UAH 302.80. Group 2 pays 20% of the minimum wage, i.e. UAH 1,420 per month. And entrepreneurs of the 3rd group must deduct 5% of the amount of income for a calendar month. In the case of value-added tax, it is 3%.